According to Merriam Webster dictionary, to recognize something means to acknowledge formally. In accounting, recognition means to formally report an event in the financial statements. For example, Uncle Joe buys a cup of lemonade from you, Uncle Joe says he has no money to pay you at the time but he promises he will pay next week when he comes back to visit. Uncle Joe buying lemonade from you is a recognized event even though no cash was exchanged.

- For example, a retailer that sells products to customers at a physical store would use the point of sale method to recognize revenue.

- Second, because historical cost valuation is the result of an exchange transaction between two independent parties, the agreed on exchange value is objective and highly verifiable.

- Hence, both revenues and expenses should be able to be reasonably measured.

- This method is used when the risks and rewards of ownership transfer to the customer over time.

- The point of sale method recognizes revenue at the time of sale, regardless of when the payment is received.

- Businesses and clients need to adhere to the agreed standard procedure before they can recognize revenue.

Do All Businesses Need to Follow Revenue Recognition Principles?

There is a definite cause-and-effect relationship between Dell Inc.’s revenue from the sale of personal computers and the costs to produce those computers. Commissions paid to salespersons for obtaining revenues also is an example of an expense recognized based on this approach. Some revenue-producing activities call for revenue recognition over time, rather than at one particular point in time. For example, revenue recognition could take place during the earnings process for long-term construction contracts. That chapter also describes in more detail the concept of an earnings process and how it relates to performance measurement. For example, the sale of a car with a complementary driving lesson would be considered as two performance obligations – the first being the car itself and the second being the driving lesson.

Advance Payment for Services

The business entity principle simply means that, for the purpose of maintaining accounting records, the business is treated as a separate entity from the owner(s) of the business. The Conceptual Framework refers to a ‘reporting entity’ which is an entity that is required, or chooses, to prepare financial statements. Equally, preparers should not be ‘overly prudent’ to the extent that they pick the lowest possible outcome simply to avoid the risk of overstating assets and income or understating liabilities and expenses.

Great! The Financial Professional Will Get Back To You Soon.

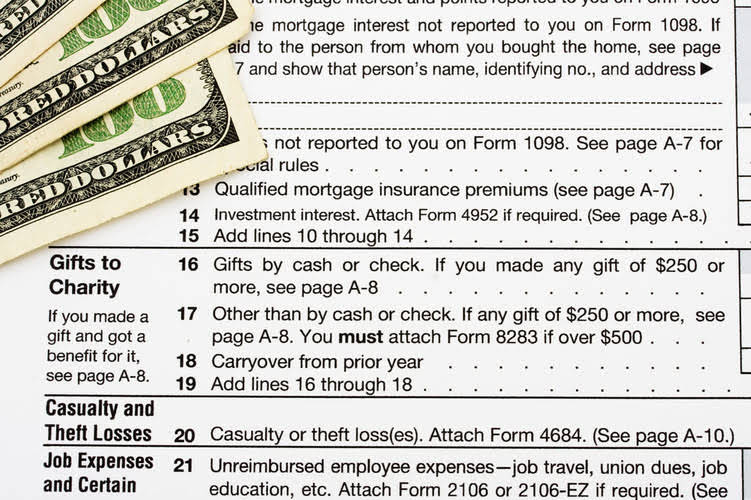

By following these criteria, a company can provide reliable and accurate financial information to its stakeholders. One of the key concepts is the realization principle stating that revenue should be recognized when it’s earned, and the company has substantially completed its performance obligations to the customer. Certain businesses must abide by regulations when it comes to the way they account for and report their revenue streams. Public companies in the U.S. must abide by generally accepted accounting principles, which sets out principles for revenue recognition. This prevents anyone from falsifying records and paints a more accurate portrait of a company’s financial situation.

Revenue Realization vs Revenue Recognition: What’s the Difference?

As another example, consider that Mr. A sells goods worth $2,000 to Mr. B. The latter consents that the goods will be transferred after 15 days. This does not mean that everything in the accounts needs to be treated the same by every entity. While an awareness of what is meant by ‘a different basis’ might be expected (for example, break up basis), candidates would not be expected to apply that basis to calculate values in the FA2 exam. Access and download collection of free Templates to help power your productivity and performance. The seller must have a reasonable expectation that he or she will be paid for the performance. To see how Synder streamlines business processes, sign up for a 15-day free trial (no credit card required!) or book office hours with a support specialist.

- The timing difference between realization and recognition can have significant implications for financial reporting.

- This provision leads to a reduction of gross revenue to net realizable revenue to prevent the overstatement of revenues.

- Alternatives such as measuring an asset at its current market value involve estimating a selling price.

- While the realization principle helps businesses recognize revenue accurately in their financial statements, it doesn’t necessarily reflect the cash flow during a particular period.

- Access and download collection of free Templates to help power your productivity and performance.

- The asset used to pay the employee, cash, provides benefits to the company only for that one month and indirectly relates to the revenue recognized in that same period.

Find out how you can get more accurate forecasts

- The third criterion for revenue recognition is the determination of the transaction price.

- That’s where the cash flow statement, another financial statement, becomes vital to understand the inflow and outflow of cash within a business.

- The first is that there is no legal differentiation between Andrea and her business.

- SaaS businesses use the accrual-basis accounting method to differentiate between revenue realization and revenue recognition.

- Thus, if Andrea has incurred the responsibility to pay for the goods, she has clearly increased a liability.

- The transaction price refers to the amount of consideration that an entity is expected to entitle to in exchange of transferring the promised goods or services.

Revenue recognition dictates when and how a company should record its revenue on its financial statements. It requires businesses to recognize revenue once it’s been realized and earned—not when the cash has been received. These criteria help ensure that a revenue event is not recorded until an enterprise has performed all realization in accounting or most of its earnings activities for a financially capable buyer. The primary earnings activity that triggers the recognition of revenue is known as the critical event. The critical event for many businesses occurs at the point-of-salethe goods or services sold to the buyer are delivered (the title is transferred)..